STR Global: Asia/Pac and China Hotel Results for 2012

release time : 2013-01-30 view count : 1230 次

Hotels in the Asia/Pacific region experienced positive results in the three key performance metrics in 2012 when reported in U.S. dollars, according to data compiled by STR Global.

In 2012, the Asia/Pacific region’s occupancy ended the year virtually flat with a 0.5-percent increase to 68.3 percent, its average daily rate increased 0.9 percent to US$129.26 and its revenue per available room was up 1.4 percent to US$88.25.

“Asia/Pacific,

with its 1.4 percent RevPAR increase, saw a slower growth rate in all

three key performance indicators during 2012 than during 2011”, said

Elizabeth Randall Winkle, managing director of STR Global. “Looking at

the underlying factors of supply and demand, demand has been outpacing

supply increases over the past three years, and demand grew 3.5 percent

during 2012. The region’s RevPAR of US$88.24 for 2012 is just short of

the US$89.71 from 2008, which represents the highest RevPAR achieved

over the past 14 years.

“Out of the countries we track across the region, Thailand and Japan had strong RevPAR improvements in local currency, highlighting their recoveries from 2011 events”, she continued. “New Zealand, on the other hand, saw the biggest drop of RevPAR across the region with 8.5-percent decline, as the performance compared against the 2011 Rugby World Cup”.

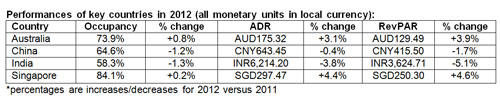

Highlights from key market performers for 2012 in local currency (year-over-year comparisons):

Bangkok,

Thailand (+11.0 percent to 70.5 percent), and Tokyo, Japan (+10.4

percent to 82.5 percent), achieved the largest occupancy increases

for the year.

Ho Chi Minh City, Vietnam, fell 5.4

percent in occupancy to 63.7 percent, posting the largest decrease in

that metric, followed by Bali, Indonesia, with a 4.1-percent decrease to

69.8 percent.

Three markets experienced double-digit

ADR increases: Jakarta, Indonesia (+17.9 percent to IDR930,099.39);

Taipei, Taiwan (+12.0 percent to TWD5,599.24); and Tokyo (+10.2 percent

to JPY14,528.61).

Four markets achieved RevPAR growth

of more than 10 percent: Tokyo (+21.6 percent to JPY11,990.11); Jakarta

(+19.0 percent to IDR667,120.13); Bangkok (+16.9 percent to

THB2,052.69); and Phuket, Thailand (+10.9 percent to THB2,851.38).

Auckland, New Zealand, reported the largest ADR (-13.9 percent to NZD136.42) and RevPAR (-15.1 percent to NZD102.62) decreases for the year.

Highlights from key market performers for 2012 in U.S. dollars (year-over-year comparisons):

Taipei rose 11.9 percent in ADR to US$189.38, reporting the largest increase in that metric.

Delhi,

India (-16.7 percent to US$141.91), and Mumbai, India (-14.9 percent to

US$149.05), posted the largest decreases for the year.

Four

markets experienced RevPAR growth of more than 10 percent: Tokyo (+19.8

percent to US$149.56); Bangkok (+15.8 percent to US$65.95); Jakarta

(+11.3 percent to US$70.75); and Phuket (+10.6 percent to US$91.80).

Delhi fell 17.2 percent in RevPAR to US$88.34, reporting the largest decrease in that metric.

In December 2012, the Asia/Pacific region reported a 0.2-percent increase in occupancy to 66.6 percent, it rose 1.2 percent in ADR to US$133.00 and it was up 1.4 percent in RevPAR to US$88.64.

Source:Global STR